Why Is the Demand for Money Downward Sloping

In other words lower interest rates increase the quantity demanded of money. Money demand is always downward sloping because when the cost of holding money increases eg.

The Diagram Below Shows The Demand For Money And The Supply Of Money Image Explain Why The Money Demand Curve Is A Downward Sloping Curve Suppose The Interest Rate Is At I A

The EPS control unit shuts the system down by opening the fail-safe and power relays.

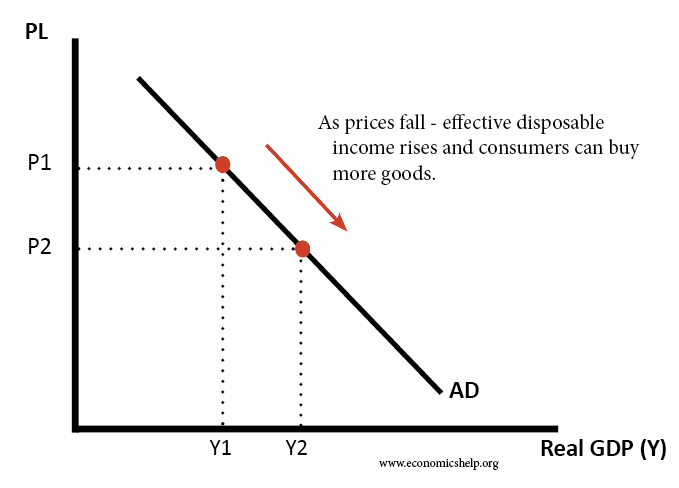

. On the contrary when the interest rate declines more individuals prefer to hold cash in hand as the reward on savings is less. The IS curve is downward sloping because as the interest rate falls investment increases thereby increasing output. The Wealth Effect states that a decrease in the price level makes consumers wealthier which increases consumer spending.

Generally a demand curve slopes downward to the right or it is negatively sloped because of. The general criteria for a personality disorder in the DSM-5 is seen in the following. The LM curve is upward sloping because higher income results in higher demand for money thus resulting in higher interest rates.

This problem has been solved. Individuals supply loanable funds through savings. Because the demand for money is high and as the wage goes down the incidence of tax will be more.

This illustrates an inverse relationship between money and the interest rate which leads to a downward-sloping demand curve for money. Why is the aggregate demand curve sloping. The demand curve for money shows the quantity of money demanded at a given interest rate.

As the interest rate increases so too do bond prices. Purchasers have more money to spend on the same product when it is sold at a reduced price allowing them to purchase more of it overall. Approved by eNotes Editorial Team Ask a.

Why is the investment demand curve downward sloping. Why is the demand curve for money downward sloping. The Wealth Effect the Interest Rate Effect and the Exchange Rate Effect.

The money demand curve slopes downward because a higher interest rate increases the opportunity cost of holding money which leads the public to demand less quantity of money. Three reasons 1 lower price - real income increases. As the interest rate increases the opportunity cost of holding money also increases Od.

When supply for savings increases quantity of loanable funds increases and the real interest rate decreases. On a graph with price on the vertical axis and quantity on the horizontal this is shown as a demand curve sloping downward from left to right. The LM curve describes the money market equilibrium.

Diagram and explanation of why AD curve is downwardly sloping. A demand curve is a representation of the relationship between the price of commodities and the total amount of quantity demanded. This curve is always downward sloping due to an inverse relationship between price and demand.

Likewise why the demand curve is downward sloping. If the interest rate equilibrates the loanable funds market but is too high to equilibrate the money market what will happen to the price of financial assets. The system continues to operate with a slightly reduced power-steering assist c.

Start studying Econ Ch. So that is why the demand curve for money slopes downward -- higher interest rates make higher opportunity cost of holding your wealth in money. The demand curve is downward sloping because as the interest rate decreases firms will want to borrow more money.

Income and Substitution effect. Why is the money demand curve downward sloping. It becomes more attractive to hold money as the interest rate.

The demand curve is downward sloping because the lower the interest rate the less demand for borrowing. The most important tool that explains this relationship is the demand curve. The demand curve for money is downward sloping which means that people want to hold less of.

Learn vocabulary terms and more with flashcards games and other study tools. Firms demand loanable funds investment. The supply curve is upward sloping because the higher the interest rate the more willing supplier of loanable funds will be to lend money B.

The IS curve is downward sloping because as the interest rate falls investment increases thus increasing output. Law of diminishing marginal utility states that with successive increase in consumption of the units of a commodity every additional unit of that commodity gives lesser satisfaction or lesser marginal utility to the consumer. Why is the demand for money downward-sloping.

1 Law of diminishing marginal utility. The demand curve slopes downward because of diminishing marginal utility and also because of the substitution and income effects. The LM curve describes equilibrium in the market for money.

Why is the asset demand for money curve downward-sloping. By doing so we can identify three distinct but related reasons why the aggregate demand curve is downward sloping. The law of demand explains the functional relationship between the price of a commodity and its demand.

As people hold larger quantities of money the interest rate is forced down. The LM curve slopes upward because higher income leads to higher demand for money thus leading to higher interest rates. Interest rates rise the quantity of money consumers hold decreases.

The reason why the demand curve is downward sloping is because of the following two reasons. The system continues to operate normally but the EPS warning light is illuminated b. The demand curve slopes downward because when the price of x is reduced the demand for x begins to rise as a result.

2 lower price exports more. The demand curve is downward sloping because the higher the interest rate the less demand for. Write the net ionic equation for the reaction that takes place between aqueous magnesium chloride and aqueous sodium hydroxide.

The income effect says that as the price of a good increases consumers are able to afford less goods and therefore purchase less goods.

Why Is The Aggregate Demand Ad Curve Downward Sloping Economics Help

Solved A Explain Why The Money Demand Curve Is A Downward Sloping Curve B Suppose The Interest Rate Is At I A Explain How Firms And Households A Course Hero

J A Sacco Module 28 31 The Money Market And The Equation Of Exchange Ppt Download

Comments

Post a Comment